You may not think about the Federal Reserve much. In fact, if you’re a normal person (i.e. not a professor of international political economy), you probably don’t think about it at all. But it impacts nearly every aspect of your life, and President Trump is doing a lot to break its ability to do its job. If he succeeds, that is going to hit your wallet hard.

For months, Trump has talked privately of firing Fed Chair Jay Powell. Meanwhile, Trump is pressing ahead with firing other high-ranking officials, which has set up the possibility that the Supreme Court would overturn what is known as “Humphrey’s Executor.” If that happens, Trump would likely have a more clear path to firing Powell or at least some of the other Federal Reserve officials below him. Even outside of that, Trump has claimed that he has the power to fire Powell. Earlier this week, after strongly negative reactions from markets, Trump said he won’t fire Powell, but his erratic approach to tariffs means you can’t take that statement particularly seriously. The Fed is still in the crosshairs.

Here’s why this matters for you, why Trump is targeting the Fed, and what Congress can do to stop him.

Central Bank Independence Matters for Your Wallet

Central banks like the Federal Reserve control the money supply. They have a dual mandate: when the economy is running too slowly (as during a recession), it’s their job to increase the money supply which acts as hitting a gas pedal for the economy; when the economy is running too hot (as it is when there’s high inflation), it’s their job to reduce the money supply which acts as hitting the brakes on the economy.

There’s a reason we don’t trust politicians with this job, and it is because running the economy too hot has short-term benefits for a politician (it leads to more jobs and higher wages) but longer-term costs that are more diffuse but just as important (it leads to higher inflation). Knowing this, a cynical politician can increase the money supply in the lead up to re-election. That leads to higher prices.

Investors, businesspeople, and other economic observers understand this set of mismatched incentives and so quite reasonably doubt the politician’s willingness to hold down inflation. Because those observers anticipate prices going up, they raise their own prices. Once they see prices going up, workers demand higher wages to compensate. Once businesses’ labor costs go up, they raise prices to compensate, and so the spiral continues. In other words, when the Federal Reserve isn’t politically independent, that drives up the cost of the things you buy.

The Price of Political Interference in Central Banking

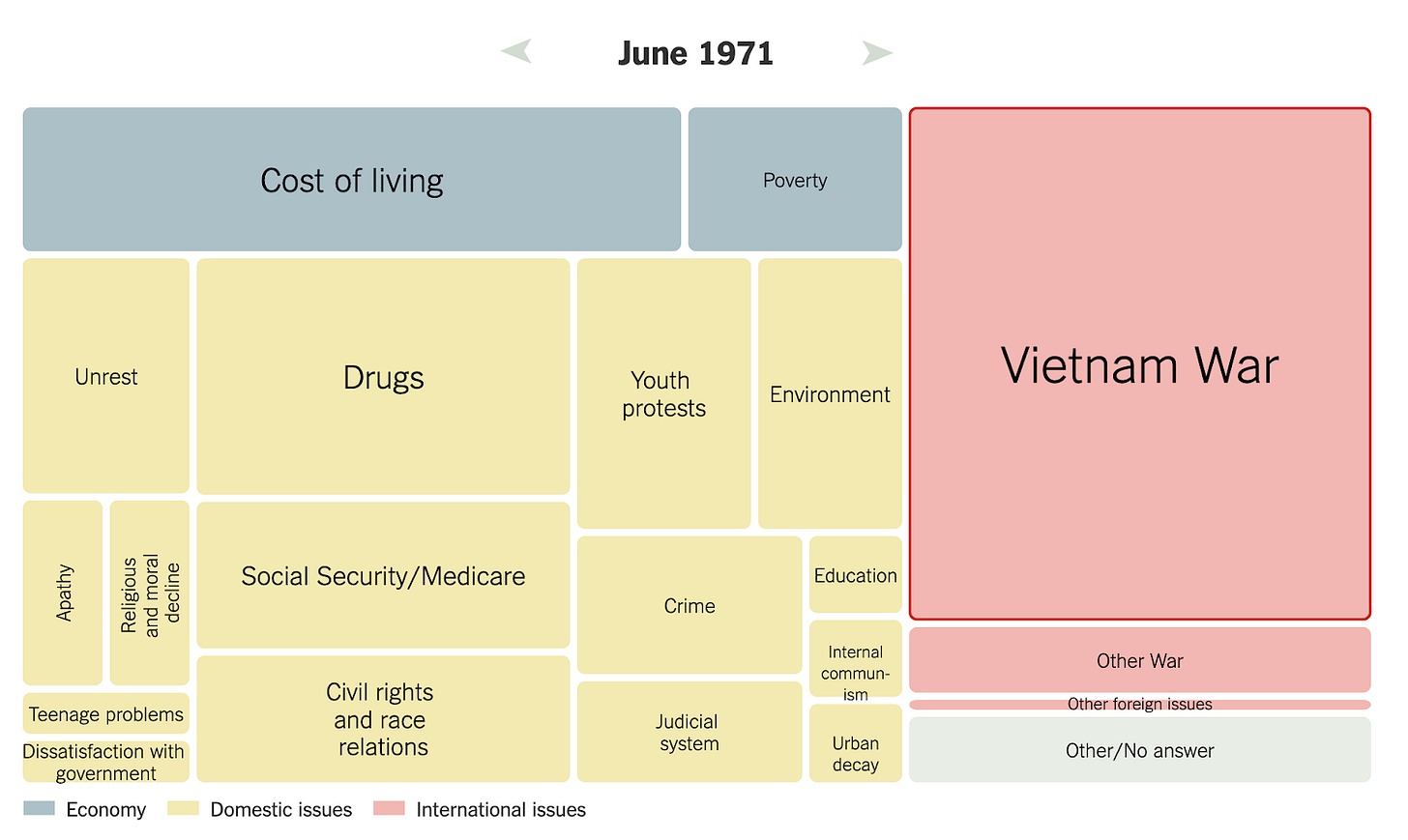

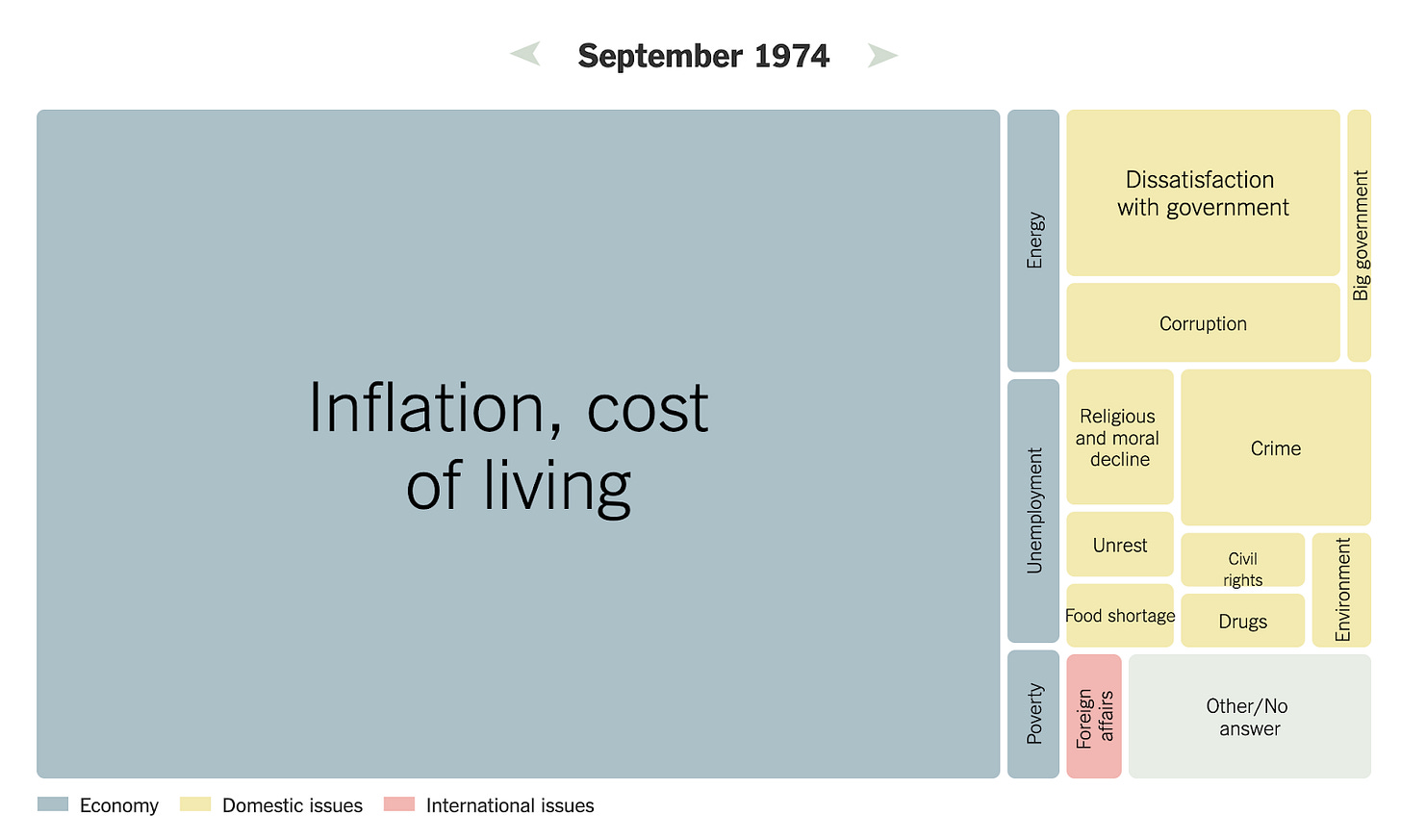

This is not some hypothetical problem. It is quite literally what happened in the 1970s. In 1971, President Nixon appointed Arthur Burns as Fed Chairman, and almost immediately began pressuring him to pursue expansionary monetary policies despite rising inflation. Nixon, focused on his 1972 reelection campaign, wanted low interest rates to stimulate short-term economic growth. Burns ultimately acquiesced, keeping monetary policy loose when it should have been tightening. The White House tapes later revealed Nixon explicitly telling Burns: "We'll take inflation if necessary, but we can't take unemployment." The result? Inflation skyrocketed to over 12% by 1974. The cost of living went from one of a number of concerns Americans had to the dominant national problem.

Yes, there were other factors at the time like the first oil price spike, but economists and historians place a huge amount of the blame for the stagflation of the 1970s at the feet of Nixon and his decision to not respect the Federal Reserve’s independence.

And it’s not just this one case from the United States. Look abroad and you'll see the catastrophic consequences when central banks become political puppets. In Turkey, President Erdogan has repeatedly fired central bank officials who wouldn't lower interest rates as he demanded, leading to the Turkish lira losing 90% of its value over the past decade and inflation rates hitting 75%. Even worse stories have played out in Argentina and Venezuela.

The Mess is of Trump’s Own Making – And It’s Hurting Your Wallet

So why is President Trump doing what he’s doing? As with much else, it starts with his tariffs. Trump sees jacking up tariffs as his economic silver bullet. Slap taxes on imports, bring jobs "back home." Simple, right? Except there's nothing simple about it. These tariffs raise prices for everyday Americans while simultaneously harming the very manufacturing jobs they were supposed to protect. Why? Because modern manufacturing doesn't work like it's 1955. Today's factories don't just import finished goods; they import components, raw materials, and machinery. Nearly half of all imports are inputs. When you make those inputs more expensive, you don't create more jobs, you destroy them.

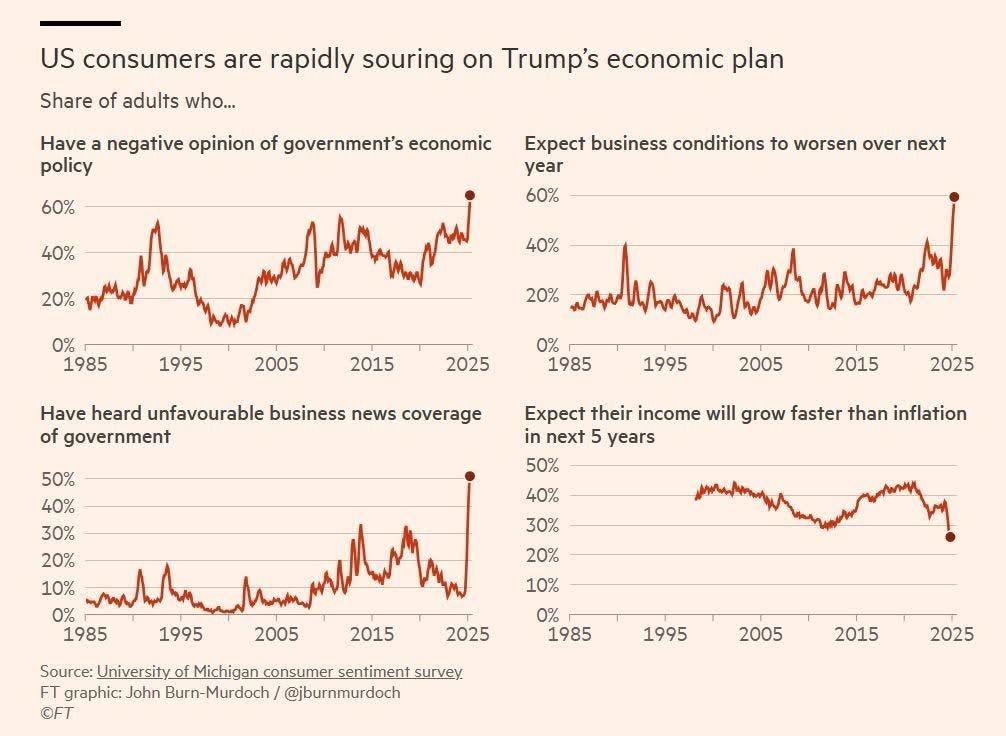

So now Trump faces a dilemma. Rising prices are making voters angry, and job losses are making headlines. So what does he do? He looks for someone else to fix his mess. Enter the Federal Reserve. ‘Cut interest rates!’ he demands. ‘Goose the economy to hide the damage I've done!’ And now that the Fed is hesitating – recognizing that cutting rates would pour gasoline on an inflation fire – Trump is threatening to cross the rubicon and fire the Fed Chair if rates don't come down.

What Congress Can Do

This isn't just bad economics; it's institutional vandalism. When a President threatens the Fed this way, he's telling markets that America's monetary policy is no longer guided by economic expertise but by political desperation. Bond markets are getting quite nervous and the dollar is starting to lose value because inflation expectations are ticking up… fast. If people believe that the Fed will cave to political pressure rather than fight inflation, they start raising prices in anticipation. The inflation genie escapes the bottle, and as we learned in the 1970s, getting it back in requires years of economic pain.

If Congress wants to stop this economic calamity, they can, and should, amend the Federal Reserve Act to explicitly strengthen the Fed Chair’s job security. Right now, the law states that Fed governors (including the Chair) can only be removed "for cause." That is typically interpreted as misconduct, not policy disagreements. But this protection hasn't been thoroughly tested in court. Congress could eliminate this ambiguity by specifically prohibiting removal based on monetary policy decisions, setting a clear judicial standard for not just Trump but any President tempted to test these waters.

Congress could also create automatic triggers that would kick in if a President attempts to subvert Fed independence. For example, legislation could require an automatic congressional review if a Fed Chair is dismissed, with the ability to reinstate them by majority vote. When Congress acts as the grown-up in the room, standing up for the independence that makes our monetary system work, it sends a powerful message: America's long-term economic stability isn't up for grabs, no matter who sits in the Oval Office.

-GW

We need to think beyond fed independence. Both political parties will continue to move to reduce fed independence. It is in their self interest. Instead we should think of some other form of independence that removes any government involvement. In a sense bitcoin serves that purpose, but is immature. It will take some form of independent store of value to resolve.